Hard Money Lenders make high-interest-rate (10-14%) loans secured by real estate. Let's break Loan Origination down into 8 steps:

1. Marketing for Borrowers

2. Comping Loan Collateral

3. Loan Structuring & Commitment

4. Collateral File Assembly

5. Title Review

6. Drawing Loan Docs

7. Drawing Lender’s Escrow Instructions

8. Funding & Closing

Previously on Hard Money Monday, I discussed Title Review. Today, I’ll discuss Drawing Loan Docs. The first rule of drawing loan docs is you don’t talk to title about drawing loan docs. Their incentives aren't 100% aligned with yours so we can’t have title companies drawing loan docs for our borrowers.

When I made my first private money loan back in 2010, I had a local attorney draw up docs. I intended to use these same docs again and again.

The problem was two-fold. Firstly, laws kept changing. Not a lot, but enough. I wanted the responsibility of having the best and the most up-to-date docs on someone else’s shoulders.

The second problem was that different deal types required different docs. Have a condo? That’s one set of docs. Making a loan cross-collateralized by several properties? That’s a different set of loan docs? Have a rental? That set of loan docs is different than an unoccupied fix and flip loan.

Today I have an attorney draw docs for each loan that I’m funding. Each state tends to have a few attorneys whose business is focused on private lending (possible bonus if you’re ever on the hunt for nonperforming loans, occasionally these lawyers also do work for banks).

Let's explore some critical loan documents:

Note

Security Instrument

Guaranty

Language Capacity Declaration

Use of Proceeds Declaration

NOTE

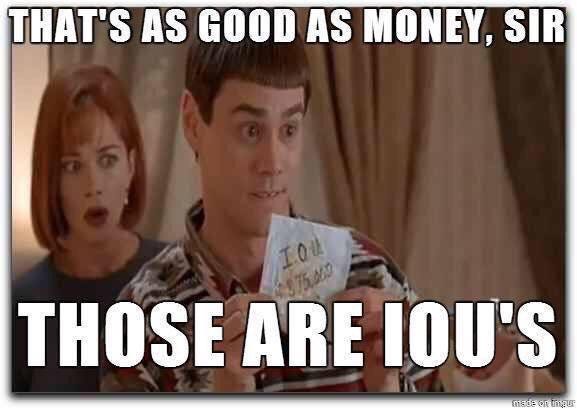

On its own, a (Promissory) Note is just an IOU. The lender holds it as evidence of the debt.

A note includes:

the loan amount

the borrower's name

the borrower’s address

the property address

the loan term

the interest rate

Any late charges and when they’d be applied

the default interest rate

a prepayment penalty if applicable.

On its own, an IOU is only as good as the character of its borrower.

SECURITY INSTRUMENT

It’s the security instrument that turns a promise (IOU) into something with teeth. That’s because it’s the security instrument that attaches to a piece of loan collateral. In the case of private money lenders, this loan collateral is in the form of a specific property or properties.

The most common types of security instruments are the Deed of Trust and the Mortgage.

They contain:

All Parties Names & Addresses

Note Amount

Property Address

Property Legal Description

Covenants (Promises)

GUARANTY

In the world of a private money lender, our borrowers are typically members of a bunch of one-off entities. Under the Note, these entities promise to pay the debt. But Razzle Dazzle, LLC doesn’t have the credit rating of Starbucks.

What do we do as a Lender? We have members of these underlying entities sign Personal Guarantees (PGs), meaning these individuals now personally promise to pay the debt. Psychologically PGs act like Damoclean Swords, incentivizing borrowers to figure out how to pay you back. I’ve had a ton of them as a borrower over-the-course of my life and they’re no fun.

How easy is it to collect on a personal guarantee? It depends on the state and county but at the very least, if you get a judgment against your guarantor you can record it in the county where they do deals and potentially cloud future sales that your guarantor intends to make. How? Remember when we discussed Title Review? A recorded judgment should appear in a title search and wind up on SCHEDULE B, PART I of a future title commitment (preliminary title report) as a condition that has to be satisfied before your guarantor can sell future property.

LANGUAGE CAPACITY DECLARATION

With this document the borrower makes a handwritten declaration that they’re fluent in English and understand the loan docs. It wards off a foreclosure defense that they didn’t understand the docs because they don’t speak/understand English. Not that I expect this kind of defense from our borrowers but it’s a bit akin to Junior Soprano developing “senility” to avoid prison.

USE OF PROCEEDS DECLARATION

Have I mentioned we don’t make loans to consumers? I want a signer on behalf of the borrower to tell me exactly what the proceeds of the loan are going to be used for along with her business plan—in her own handwriting.

That’s a wrap. In my next edition of Hard Money Monday, I’ll discuss Drawing Lender’s Escrow Instructions.